What Is The Inheritance Tax For Iowa . Spouses are exempt from the tax. the tax is based upon a beneficiary’s right to receive money or property which was owned by the decedent at the date of death. inheritance tax is a tax on the transfer of assets from a deceased person to their beneficiaries. when a loved one passes away and leaves behind property, you may be required to pay iowa inheritance taxes. How much, or whether you pay. in this detailed guide of iowa inheritance laws, we break down intestate succession, probate, taxes, what. an iowa inheritance tax return must be filed for an estate when the gross share, subject to tax without reduction for liabilities, of. iowa levies an inheritance tax on assets transferred to heirs based on their relationship to the deceased. for decedents dying on or after january 1, 2022, but before january 1, 2023, the applicable tax rates listed in iowa code.

from www.formsbank.com

in this detailed guide of iowa inheritance laws, we break down intestate succession, probate, taxes, what. for decedents dying on or after january 1, 2022, but before january 1, 2023, the applicable tax rates listed in iowa code. the tax is based upon a beneficiary’s right to receive money or property which was owned by the decedent at the date of death. an iowa inheritance tax return must be filed for an estate when the gross share, subject to tax without reduction for liabilities, of. when a loved one passes away and leaves behind property, you may be required to pay iowa inheritance taxes. iowa levies an inheritance tax on assets transferred to heirs based on their relationship to the deceased. How much, or whether you pay. Spouses are exempt from the tax. inheritance tax is a tax on the transfer of assets from a deceased person to their beneficiaries.

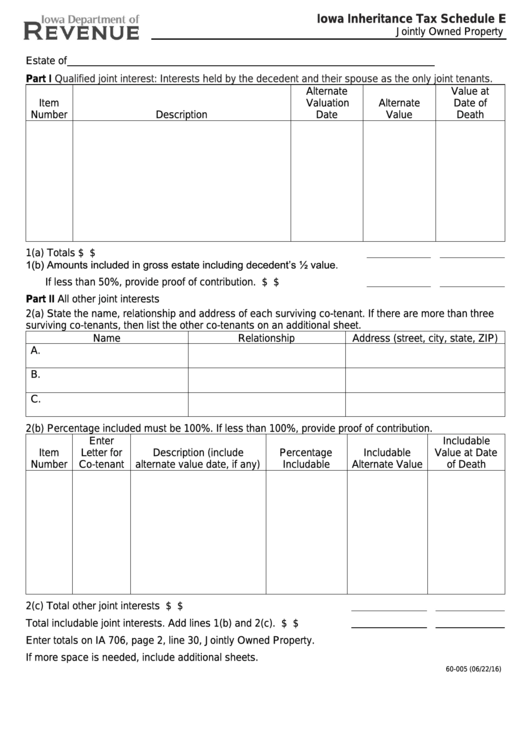

Schedule E Iowa Inheritance Tax printable pdf download

What Is The Inheritance Tax For Iowa inheritance tax is a tax on the transfer of assets from a deceased person to their beneficiaries. when a loved one passes away and leaves behind property, you may be required to pay iowa inheritance taxes. an iowa inheritance tax return must be filed for an estate when the gross share, subject to tax without reduction for liabilities, of. inheritance tax is a tax on the transfer of assets from a deceased person to their beneficiaries. for decedents dying on or after january 1, 2022, but before january 1, 2023, the applicable tax rates listed in iowa code. in this detailed guide of iowa inheritance laws, we break down intestate succession, probate, taxes, what. iowa levies an inheritance tax on assets transferred to heirs based on their relationship to the deceased. Spouses are exempt from the tax. How much, or whether you pay. the tax is based upon a beneficiary’s right to receive money or property which was owned by the decedent at the date of death.

From wealthfit.com

Inheritance Tax How Much Will Your Children Get? Your Estate Tax What Is The Inheritance Tax For Iowa an iowa inheritance tax return must be filed for an estate when the gross share, subject to tax without reduction for liabilities, of. in this detailed guide of iowa inheritance laws, we break down intestate succession, probate, taxes, what. How much, or whether you pay. inheritance tax is a tax on the transfer of assets from a. What Is The Inheritance Tax For Iowa.

From www.templateroller.com

Form 60014 Fill Out, Sign Online and Download Printable PDF, Iowa What Is The Inheritance Tax For Iowa in this detailed guide of iowa inheritance laws, we break down intestate succession, probate, taxes, what. iowa levies an inheritance tax on assets transferred to heirs based on their relationship to the deceased. the tax is based upon a beneficiary’s right to receive money or property which was owned by the decedent at the date of death.. What Is The Inheritance Tax For Iowa.

From taxfoundation.org

2023 State Estate Taxes and State Inheritance Taxes What Is The Inheritance Tax For Iowa iowa levies an inheritance tax on assets transferred to heirs based on their relationship to the deceased. How much, or whether you pay. for decedents dying on or after january 1, 2022, but before january 1, 2023, the applicable tax rates listed in iowa code. the tax is based upon a beneficiary’s right to receive money or. What Is The Inheritance Tax For Iowa.

From taxfoundation.org

Estate and Inheritance Taxes by State, 2017 What Is The Inheritance Tax For Iowa for decedents dying on or after january 1, 2022, but before january 1, 2023, the applicable tax rates listed in iowa code. inheritance tax is a tax on the transfer of assets from a deceased person to their beneficiaries. an iowa inheritance tax return must be filed for an estate when the gross share, subject to tax. What Is The Inheritance Tax For Iowa.

From www.formsbank.com

Form Ia706 Iowa Inheritance/estate Tax Return printable pdf download What Is The Inheritance Tax For Iowa iowa levies an inheritance tax on assets transferred to heirs based on their relationship to the deceased. an iowa inheritance tax return must be filed for an estate when the gross share, subject to tax without reduction for liabilities, of. in this detailed guide of iowa inheritance laws, we break down intestate succession, probate, taxes, what. . What Is The Inheritance Tax For Iowa.

From hrlawomaha.com

Iowa Inheritance Tax Changes Hightower Reff Law What Is The Inheritance Tax For Iowa iowa levies an inheritance tax on assets transferred to heirs based on their relationship to the deceased. Spouses are exempt from the tax. the tax is based upon a beneficiary’s right to receive money or property which was owned by the decedent at the date of death. an iowa inheritance tax return must be filed for an. What Is The Inheritance Tax For Iowa.

From www.signnow.com

Iowa Inheritance Tax Form Fill Out and Sign Printable PDF Template What Is The Inheritance Tax For Iowa for decedents dying on or after january 1, 2022, but before january 1, 2023, the applicable tax rates listed in iowa code. Spouses are exempt from the tax. How much, or whether you pay. iowa levies an inheritance tax on assets transferred to heirs based on their relationship to the deceased. when a loved one passes away. What Is The Inheritance Tax For Iowa.

From www.templateroller.com

Form IA706 (60008) Download Fillable PDF or Fill Online Iowa What Is The Inheritance Tax For Iowa when a loved one passes away and leaves behind property, you may be required to pay iowa inheritance taxes. inheritance tax is a tax on the transfer of assets from a deceased person to their beneficiaries. How much, or whether you pay. for decedents dying on or after january 1, 2022, but before january 1, 2023, the. What Is The Inheritance Tax For Iowa.

From www.templateroller.com

Form 60014 Fill Out, Sign Online and Download Printable PDF, Iowa What Is The Inheritance Tax For Iowa in this detailed guide of iowa inheritance laws, we break down intestate succession, probate, taxes, what. Spouses are exempt from the tax. iowa levies an inheritance tax on assets transferred to heirs based on their relationship to the deceased. when a loved one passes away and leaves behind property, you may be required to pay iowa inheritance. What Is The Inheritance Tax For Iowa.

From iowalum.com

The Inheritance Tax in Iowa How to file What Is The Inheritance Tax For Iowa inheritance tax is a tax on the transfer of assets from a deceased person to their beneficiaries. an iowa inheritance tax return must be filed for an estate when the gross share, subject to tax without reduction for liabilities, of. in this detailed guide of iowa inheritance laws, we break down intestate succession, probate, taxes, what. How. What Is The Inheritance Tax For Iowa.

From www.iowaestateplan.com

Iowa Inheritance Tax A Thing of the Past in the Future? What Is The Inheritance Tax For Iowa the tax is based upon a beneficiary’s right to receive money or property which was owned by the decedent at the date of death. inheritance tax is a tax on the transfer of assets from a deceased person to their beneficiaries. for decedents dying on or after january 1, 2022, but before january 1, 2023, the applicable. What Is The Inheritance Tax For Iowa.

From beattymillerpc.com

Death Taxes What Are They? What Is The Inheritance Tax For Iowa inheritance tax is a tax on the transfer of assets from a deceased person to their beneficiaries. when a loved one passes away and leaves behind property, you may be required to pay iowa inheritance taxes. an iowa inheritance tax return must be filed for an estate when the gross share, subject to tax without reduction for. What Is The Inheritance Tax For Iowa.

From cccpa.com

All You Need to Now About Inheritance Taxes at Federal and State Level What Is The Inheritance Tax For Iowa the tax is based upon a beneficiary’s right to receive money or property which was owned by the decedent at the date of death. in this detailed guide of iowa inheritance laws, we break down intestate succession, probate, taxes, what. for decedents dying on or after january 1, 2022, but before january 1, 2023, the applicable tax. What Is The Inheritance Tax For Iowa.

From www.oflaherty-law.com

Iowa Inheritance Tax Law Explained What Is The Inheritance Tax For Iowa an iowa inheritance tax return must be filed for an estate when the gross share, subject to tax without reduction for liabilities, of. Spouses are exempt from the tax. when a loved one passes away and leaves behind property, you may be required to pay iowa inheritance taxes. the tax is based upon a beneficiary’s right to. What Is The Inheritance Tax For Iowa.

From www.pdffiller.com

Fillable Online tax.iowa.govformsiowainheritancetaxscheduleIowa What Is The Inheritance Tax For Iowa an iowa inheritance tax return must be filed for an estate when the gross share, subject to tax without reduction for liabilities, of. in this detailed guide of iowa inheritance laws, we break down intestate succession, probate, taxes, what. inheritance tax is a tax on the transfer of assets from a deceased person to their beneficiaries. . What Is The Inheritance Tax For Iowa.

From taxpreparationclasses.blogspot.com

Iowa Inheritance Tax Return Instructions Tax Preparation Classes What Is The Inheritance Tax For Iowa in this detailed guide of iowa inheritance laws, we break down intestate succession, probate, taxes, what. when a loved one passes away and leaves behind property, you may be required to pay iowa inheritance taxes. Spouses are exempt from the tax. How much, or whether you pay. the tax is based upon a beneficiary’s right to receive. What Is The Inheritance Tax For Iowa.

From taxfoundation.org

State Estate Tax Rates & State Inheritance Tax Rates Tax Foundation What Is The Inheritance Tax For Iowa the tax is based upon a beneficiary’s right to receive money or property which was owned by the decedent at the date of death. an iowa inheritance tax return must be filed for an estate when the gross share, subject to tax without reduction for liabilities, of. iowa levies an inheritance tax on assets transferred to heirs. What Is The Inheritance Tax For Iowa.

From www.3newsnow.com

Should Iowa repeal its inheritance tax? What Is The Inheritance Tax For Iowa Spouses are exempt from the tax. iowa levies an inheritance tax on assets transferred to heirs based on their relationship to the deceased. inheritance tax is a tax on the transfer of assets from a deceased person to their beneficiaries. when a loved one passes away and leaves behind property, you may be required to pay iowa. What Is The Inheritance Tax For Iowa.